Explain the type of conflicts of interest that can arise from the development of universal banking

What will be an ideal response?

There are five main conflicts of interest:

1. The underwriting department would benefit from aggressive sales of a security to the customers of a bank where the customers would benefit from unbiased advice.

2. A bank manager may try to hard-sell an issuing firm's securities to the disadvantage of the bank customer or limit losses of an underperforming IPO to the bank's trust accounts.

3. A bank may push a bond issue of a firm with a high default risk to pay off a loan the bank has with the firm.

4. May grant favorable loan conditions to a firm in return for fees to perform underwriting activities.

5. May try to hard-sell the bank's insurance to its customers.

You might also like to view...

Refer to the figure below. In response to gradually falling inflation, this economy will eventually move from its short-run equilibrium to its long-run equilibrium. Graphically, this would be seen as

A. long-run aggregate supply shifting leftward B. Short-run aggregate supply shifting downward C. Aggregate demand shifting rightward D. Aggregate demand shifting leftward

To maximize utility consumers should buy goods and services to the point where the marginal utility of each item consumed is maximized

Indicate whether the statement is true or false

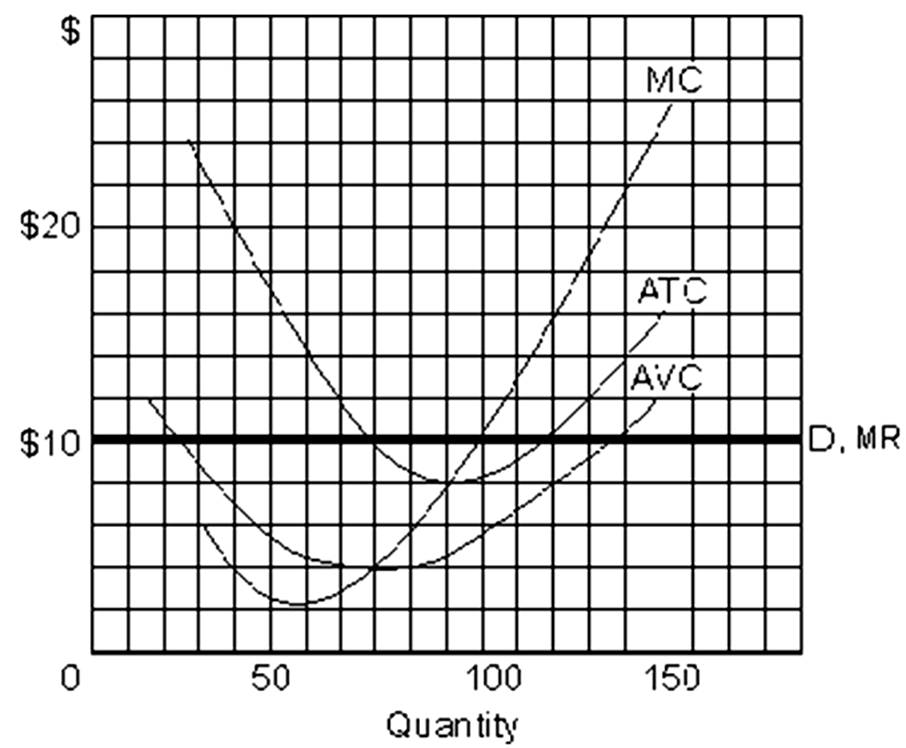

Refer to Figure 13-13. What is the area that represents the firm's profit?

A) profit = 0 B) P3baP2 C) P4edP2 D) P4eaP1

When operating at the profit-maximizing/loss-minimizing level of output, total revenue minus total cost is a little under

A. $200.

B. $100.

C. $45.

D. -$45.