You value your favorite shirt at $110. Someone else values it at $150, and that person is willing to pay you $120 for your shirt. Would selling your shirt to this person for $120 be Pareto efficient?

A. Yes, because both of you are better off as a result of the trade.

B. No, because you did not receive the maximum amount the other person would have been willing to pay for the shirt.

C. No, the person paid you $120 for the shirt so his net benefit was $30, while your net benefit was $10. For this change to be Pareto efficient, each of you should have the same net benefit.

D. Yes, because even though you gain from the trade and he loses, there is the potential for you to compensate him for his loss.

Answer: A

You might also like to view...

Barter requires the

A) exchange of goods and services directly for other goods and services. B) use of fiat money as a medium of exchange. C) use of commodity money as a medium of payment. D) the triple non-coincidence of wants. E) use of money as a unit of account.

A major contribution of the Solow model is its ________

A) insight into what distinguishes rich economies from poor economies B) explanation of why productivity grows over time C) demonstration that the key to sustained growth is a high level of saving D) encouragement of policies to limit population growth

Assume you pay a premium of $0.80/bu for a put option with a strike price of $6.00/bu and that the current futures price is $5.50/bu. Then, the option is in-the-money by:

A. $0.00/bu since there is no intrinsic value in this put option B. $0.30/bu C. $0.50/bu D. $0.80/bu

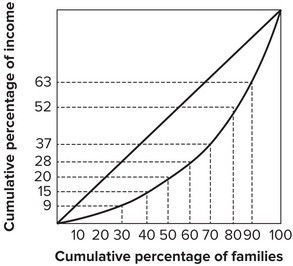

Refer to the graph shown. The fourth quintile (a quintile is a fifth) of the families earn:

The fourth quintile (a quintile is a fifth) of the families earn:

A. 28 percent of the income. B. 52 percent of the income. C. 24 percent of the income. D. 20 percent of the income.