Engineers at a semiconductor company developed an improved front-end-of-line (FEOL) formulation process that requires an investment of $6 million. The company plans to issue $6 million worth of 10-year bonds that will pay interest of 6% per year, payable annually. If the company’s effective tax rate is 40%, what is the after-tax cost (i.e., interest rate) of the debt financing?

What will be an ideal response?

Before-tax bond annual interest = 6 million*0.06 = $360,000

Annual bond interest NCF = 360,000(1 – 0.4) = $216,000

Find i* using a PW relation

0 = 6,000,000 - 216,000(P/A,i*,10) - 6,000,000(P/F,i*,10)

i* = 3.60% per year

You might also like to view...

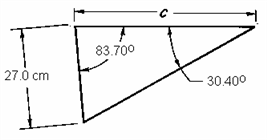

Compute the length of side c in centimeters rounded to 3 significant digits.

Fill in the blank(s) with the appropriate word(s).

Technician A says that RBS type tie rod ends do not require periodic lubrication. Technician B says that the steering gear must be removed to replace outer tie rod ends. Which technician is correct?

A) Technician A only B) Technician B only C) Both technicians A and B D) Neither technician A nor B

How many cubic feet of acetylene gas is stored in a size MC acetylene tank weighing 8.0 pounds?

A) 0 ft3 B) 7.5 ft3 C) 5 ft3 D) 10 ft3

To convert degrees into minutes, multiply the number of degrees by 60 min./degree and then express the product in terms of minutes.

Answer the following statement true (T) or false (F)