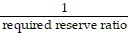

The formula  is the

is the

A. federal funds rate.

B. potential money multiplier.

C. actual change in the money supply.

D. discount rate.

Answer: B

You might also like to view...

Refer to the scenario above. The real GDP of the country in Year 1 was ________

A) $280,000 B) $2,200,000 C) $540,000 D) $1,400,000

Which of the following statements is true?

A) The more liquid the bond, the lower the yield. B) Tax-free bonds normally have a higher interest rate than other types of bonds. C) The price of a bond increases as it becomes more risky. D) The yield curve illustrates the relative default risks of alternative types of bonds.

Refer to Figure 10.3. A positive demand shock accompanied by a decrease in the real interest rate is best represented by ________ in panel (a) and ________ in panel (b)

A) a shift from AE2 to AE3; a movement from point B to point C B) a shift from AE3 to AE2; a shift from IS2 to IS1 C) a shift from AE1 to AE2; a movement from point A to point B D) a shift from AE1 to AE3; a movement from point A to point C

Which of the following is NOT covered by federal deposit insurance?

A) savings account B) money market mutual funds C) checking account D) money market deposit account