Assume the federal government collects $20 billion in taxes and spends them on the public. If the money multiplier is 2.5, bank reserves

A) and the money supply still increase by only $20 billion.

B) increase by $20 billion and the money supply increase by $50 billion.

C) and the money supply both increase by $50 billion.

D) and the money supply are unaffected.

D

You might also like to view...

Suppose you are the monopoly owner of a movie theatre. You can allow people to enter the theatre at zero marginal cost, and you can provide popcorn at a constant marginal cost of $0.50 per bag. You have two customers, Larry and Terry, who are identical twins. Larry never buys popcorn under any circumstances. If you charge the monopoly price of $1.00 per bag for popcorn, Terry will buy 2 bags of popcorn and earn $0.50 in consumer's surplus, and you will earn $1.00 in profit from popcorn sales. If you charge the competitive price of $0.50 per bag for popcorn, Terry will buy 4 bags of popcorn and earn $2.00 in consumer's surplus, and you will earn no profit from popcorn sales.

(i) Suppose that Larry is willing to pay up to $8.00 to see the movie and Terry is willing to pay up to $5.00 to see the movie. How much should you charge for admission to the theatre and how much should you charge for popcorn? (ii) Suppose that Larry is willing to pay up to $4.00 to see the movie and Terry is willing to pay up to $5.00 to see the movie. How much should you charge for admission to the theatre and how much should you charge for popcorn?

Consider a market that has linear supply and demand curves, and is in equilibrium. The area above the price line and below the demand curve is

A) consumer surplus. B) producer surplus. C) marginal cost. D) marginal benefit.

Total revenue equals

a. price x quantity. b. price/quantity. c. (price x quantity) - total cost. d. output - input.

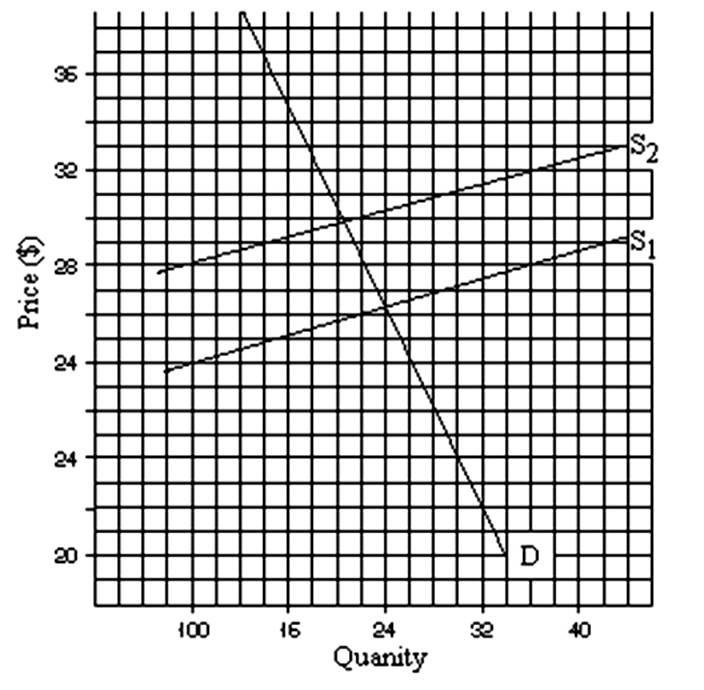

In graph: (a) How much is the tax? (b) How much of this tax is borne by the buyer? (c) How much of this tax is borne by the seller?