In most instances of differential pricing, demand from the segment paying the lower price

A) arises earlier in time than demand from the segment paying the higher price.

B) arises later in time than demand from the segment paying the higher price.

C) arises about the same time as demand from the segment paying the higher price.

D) arises both earlier and later in time than demand from the segment paying the higher price.

Answer: A

You might also like to view...

Which type of training allows trainees at different locations to attend programs online, using their computers to view lectures, participate in discussions, and share documents?

A. cross-training B. on-the-job training C. experiential programs D. action learning E. distance learning

Which of the following are included as potential external opportunities in a SWOT analysis that are helpful to an organization?

A. Expanded product line, increase in demand, new markets, new regulations. B. Core competencies, market leaders, cost advantages, excellent management. C. Lack of strategic direction, obsolete technologies, lack of managerial talent, outdated, product line. D. New entrants, substitute products, shrinking markets, costly regulatory, requirements.

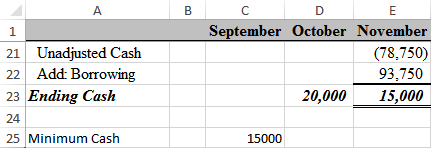

Which formula for borrowing would result in the correct value in E22?

a) =IF(E21<$C$25,C25-E21,0)

b) =IF(E21<$D$23,C25-E21,0)

c) =IF(C25<$E$21,C25-E21,0)

d) =IF(E21<$C$25,E21-C25,0)

Distributions from a retirement plan are not subject to a 10% additional tax in each of the following instances except when

A. The distribution is used to pay for medical expenses above the 7.5% AGI threshold. B. The distribution is made to pay an IRS tax levy on the plan. C. The distribution is paid to an employee to be used to pay health insurance premiums, which are not a portion of the taxpayers medical expenses above the 7.5% AGI threshold. D. The distribution is made to an employee or retiree on or after age 59½.