What new policy tools for controlling reserve balances did the Fed introduce during the Financial Crisis of 2007-2009?

What will be an ideal response?

The Fed began to pay interest on reserves. By paying a higher interest rate, it can encourage banks to maintain their reserve holdings. The term deposit facility gives the Fed another tool in managing bank reserve holdings. The more funds banks place in term deposits, the less they will have available to expand loans and the money supply.

You might also like to view...

For Product X, the income elasticity of demand is -2.56. Which of the following is therefore TRUE?

A) Product X is a necessity. B) Product X is a luxury. C) Product X is an inferior good. D) Product X is a normal good.

A cost imposed on people other than the consumers of a good or service is a:

a. price floor. b. negative externality. c. positive externality. d. price externality.

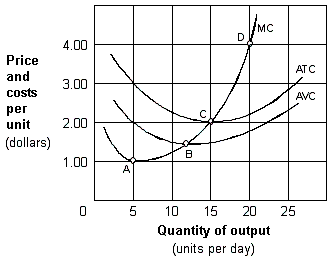

Exhibit 7-3 Cost per unit curves

?

A. continue to operate because it is earning a positive economic profit. B. stay in operation for the time being even though it is making an economic loss. C. shut down temporarily. D. increase the price.

The outcome of any free market is ultimately ________ because some people become very rich while others remain very poor.

A. efficient B. equitable C. inequitable D. market failure