Suppose the demand curve for a product is downward sloping and the supply curve is upward sloping. If a unit tax is imposed in the market for this product,

A) sellers bear the entire burden of the tax.

B) the tax burden will be shared among the government, buyers and sellers.

C) the tax burden will be shared by buyers and sellers.

D) buyers bear the entire burden of the tax.

C

You might also like to view...

The theory that monetary policy conducted on a discretionary, day-by-day basis leads to poor long-run outcomes is referred to as the

A) adverse selection problem. B) moral hazard problem. C) time-inconsistency problem. D) nominal-anchor problem.

People will choose to specialize and trade if they can acquire the goods they want:

A. at a lower cost than it would cost them to make the goods themselves. B. at a higher cost than it would cost them to make the goods themselves. C. from someone who is willing to trade with them. D. from a capitalistic system of exchange.

Which of the following statements is correct?

a. For all firms, marginal revenue equals the price of the good. b. Only for competitive firms does average revenue equal the price of the good. c. Marginal revenue can be calculated as total revenue divided by the quantity sold. d. Only for competitive firms does average revenue equal marginal revenue.

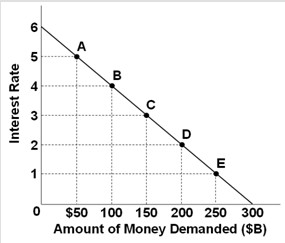

Use the following graph to answer the next question. If the interest rate rises from 2% to 3%, the supply of money must have

If the interest rate rises from 2% to 3%, the supply of money must have

A. decreased by $100 billion. B. increased by $50 billion. C. decreased by $50 billion. D. decreased by $150 billion.