If banks are currently holding zero excess reserves and the Fed lowers the required reserve ratio, which of the following will happen?

A) Banks will have a reserve deficiency.

B) Banks will have positive excess reserves.

C) Banks will extend fewer loans.

D) Banks will call in some of their loans to meet the reserve deficiency.

B

You might also like to view...

Assume that the marginal propensity to consume in an economy is 0.9. If the economy's full-employment real GDP is $500 billion and its equilibrium real GDP is $550 billion, there is an inflationary expenditure gap of

A. $5 billion. B. $500 billion. C. $100 billion. D. $50 billion.

Unlike a perfectly competitive firm, a monopolist

a. can choose how much output to produce. b. cannot increase production without affecting the price she receives for her good. c. usually sells in a market with a downward-sloping demand curve. d. has an MR from increasing output by one unit equal to the price of his product.

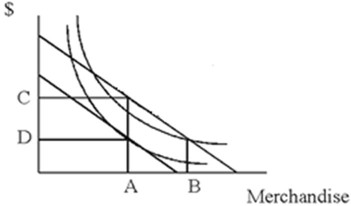

This graph below shows a consumer facing a choice between a cash gift and merchandise of greater value.  Show, using a sketch graph, why a consumer prefers a cash gift rather than a larger gift of merchandise.

Show, using a sketch graph, why a consumer prefers a cash gift rather than a larger gift of merchandise.

What will be an ideal response?

The MRP schedule of the imperfect competitor declines _____ than that of the perfect competitor.

Fill in the blank(s) with the appropriate word(s).