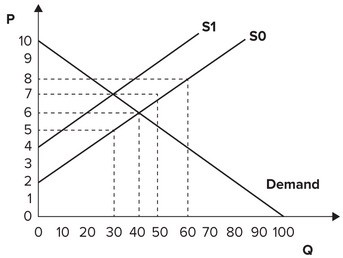

Refer to the graph shown. Assume that the market is initially in equilibrium at a price of $6 and a quantity of 40 units. If the government imposes a $2 per-unit tax on this product, it will collect tax revenue in the amount of:

A. $120.

B. $80.

C. $60.

D. $100.

Answer: C

You might also like to view...

Automatic payroll deductions help people to fight ____________________ .

Fill in the blank(s) with the appropriate word.

Health insurance plans which typically reimburse doctors and hospitals with payment for each service they provide are known as

A) single-health-payer systems. B) health maintenance organizations. C) fee-for-service plans. D) preferred provider organizations.

If economies of scale exist for a particular production relationship, long-run average costs will

A. rise. B. fall. C. first rise and then fall. D. be unaffected since there is no direct relationship between the two.

Jay was just drafted by a professional baseball team, and was offered a record-breaking contract because of his potential. This is an example of

a. a human capital differential. b. a compensating differential. c. signaling theory. d. the superstar phenomenon.