In the above table, the firm

A) must be in a perfectly competitive market because its marginal revenue is constant.

B) must be in a perfectly competitive market because its marginal cost curve eventually rises.

C) cannot be in a perfectly competitive market because its short-run economic profits are greater than zero.

D) cannot be in a perfectly competitive market because its long-run economic profits are greater than zero.

A

You might also like to view...

In the context of the production possibilities curve, opportunity cost is measured in:

a. dollars paid for the goods. b. the quantity of other goods given up. c. the value of the resources used. d. changing technology. e. units of satisfaction.

In the 1950s, a traditional, thirty-year fixed-rate mortgage would typically have been

A. available to the borrower without a down payment and without documentation of income. B. securitized and sold to a consortium of foreign investors. C. held by the original lender or banker until it was paid off. D. all of the options are correct.

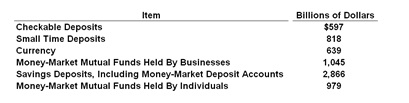

Refer to the table. The size of the M1 money supply is:

A. $979 billion

B. $1,236 billion

C. $1,415 billion

D. $1,618 billion

The trade feedback effect includes all of the following steps except

A. an increase in U.S. exports stimulates U.S. economic activity. B. an increase in U.S. economic activity stimulates U.S. imports. C. an increase in foreign income stimulates U.S. imports. D. an increase in foreign imports stimulates U.S. exports.