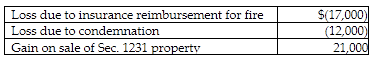

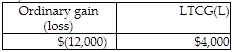

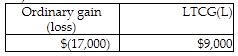

This year Jenna had the gains and losses noted below on property, plant and equipment used in her business. Each asset had been held longer than one year. Jenna has not previously disposed of any business assets.

Jenna will recognize

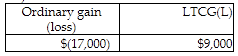

A)

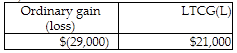

B)

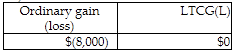

C)

D)

A)

The casualty loss on Sec. 1231 (after netting with any other casualty gains and losses) will be treated as ordinary. The condemnation loss will be netted with the Sec. 1231 gain, and the net gain will be treated as a LTCG.

You might also like to view...

At the time inventory is sold, cost of goods sold is recorded under the perpetual inventory system.

Answer the following statement true (T) or false (F)

If an accountant in public accounting seeks work as a controller in private industry, the expenses of job hunting may be deductible.

Answer the following statement true (T) or false (F)

Which of the following statements is FALSE? With a consumer proposal

A) court approval is not required for the proposal to be accepted B) a landlord cannot terminate their lease while it is in effect C) the utilities companies cannot cut off the person's services while it is in effect D) creditors cannot use an acceleration clause to demand full payments now while it is in effect E) a meeting with all creditors must occur and two-thirds must agree for the proposal to be accepted

The problem that NASA has in determining what types of cargo may be loaded on the space shuttle is an example of a knapsack problem

Indicate whether the statement is true or false