Identify the 6 main provisions of the Patient Protection and Affordable Care Act (ACA)

What will be an ideal response?

1. Individual mandate requires that every resident of the United States have health insurance or be subject to a fine.

2. State health insurance marketplaces which offer health insurance policies are required to be established in every state.

3. Employers are mandated to offer health insurance to employees, or in some cases, pay a fee to the federal government for every employee who receives a tax credit for obtaining insurance through a health exchange.

4. Insurance companies are required to participate in a high-risk pool and must provide health coverage for dependant children up to age 26. Also, lifetime dollar maximums are prohibited and limits are placed on deductibles and waiting periods for coverage to take effect.

5. Some Medicare reimbursements will be reduced.

6. New taxes have been and will be phased in to help fund the program.

You might also like to view...

The use of common property resources:

A. reduces positive externalities in many cases. B. reduces negative externalities in many cases. C. leads to positive externalities in many cases. D. leads to negative externalities in many cases.

Which of the following is true? Partial equilibrium analysis will

A) overstate the impact of a tax for both substitutes and complements. B) understate the impact of a tax for both substitutes and complements. C) understate the impact of a tax for complements and overstate the impact for substitutes. D) understate the impact of a tax for substitutes and overstate the impact for complements.

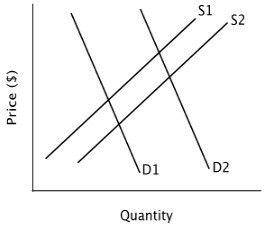

Refer to the accompanying figure. Assume demand remains unchanged at D1. If supply shifts from S2 to S1, then the equilibrium price will ________ and the equilibrium quantity will ________.

A. rise; fall B. fall; rise C. fall; fall D. rise; rise

Smith is given a voucher that can be spent only on textbooks. Smith has a budget constraint with textbooks measured along the horizontal axis and everything else on the vertical axis. Suppose everything else is comprised only of normal goods. Then

A. Smith will most likely end up spending some more money on everything else after receiving the voucher. B. the voucher does not have any impact on Smith's consumption. C. the voucher causes Smith to increase his spending on textbooks by more than the amount of the voucher. D. Smith will not buy any textbooks because he can use the voucher for all other goods.