The double taxation of corporate profit in the United States refers to the fact that

A) tax rates on partnerships are very high.

B) depreciation is not a deductible expense.

C) corporate profit is first taxed and then any dividends paid are subject to personal income tax.

D) proprietorships are not subject to any tax on earnings.

Answer: C

You might also like to view...

Consider a closed economy without the government. If the savings rate in the economy is 20% and the aggregate savings is $10,000, the aggregate consumption in the economy is:

A) $37,000. B) $45,000. C) $10,000. D) $50,000.

Tax evasion is more likely to occur when people feel that their tax dollars are not being used properly.

A. True B. False C. Uncertain

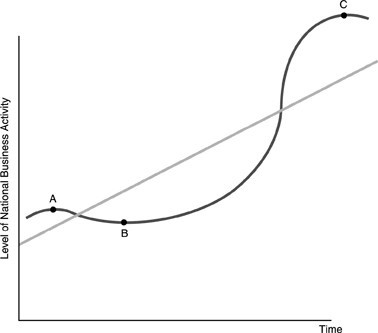

The U.S. economy is experiencing falling output, falling employment, falling incomes and rising unemployment. These conditions best describe a business cycle ________

Refer to the above figure. The points between B and C are known as

Refer to the above figure. The points between B and C are known as

A. a peak. B. a trough. C. an expansion. D. a contraction.