Eric dies in the current year and has a gross estate valued at $16,500,000. The estate incurs funeral and administrative expenses of $100,000 and also pays off Eric's debts which amount to $250,000. Eric bequeaths $600,000 to his wife. Eric made no taxable transfers during his life. Eric's taxable estate will be

A) $4,970,000.

B) $15,550,000.

C) $4,370,000.

D) $16,500,000.

B) $15,550,000.

($16,500,000 - $100,000 - $250,000 - $600,000) = $15,550,000

You might also like to view...

The costs of initially producing an intermediate product should be considered in deciding whether to further process a product, even though the costs will not change, regardless of the decision

Indicate whether the statement is true or false

Matt, a human resource manager, wants to inform all the employees about the annual renewal of the health care policy adopted by the company. The message will be simple and routine. Based on media richness, which of the following would be the most appropriate medium to communicate this message?

A. telephone B. small group meeting C. e-mail D. face-to-face discussion E. one-on-one interview

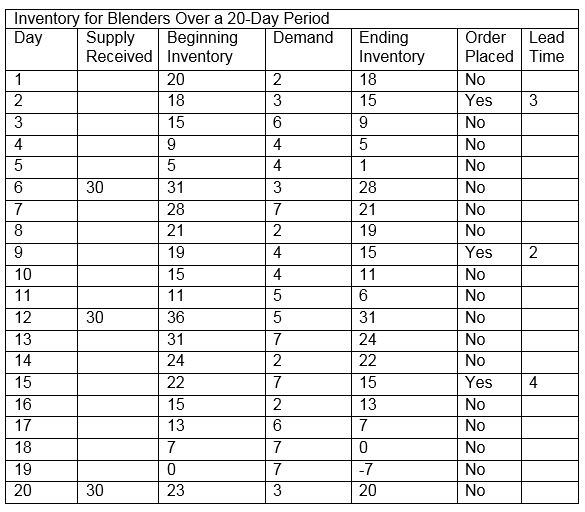

Consider the data on Inventory for Blenders Over a 20-Day Period. Any time that ending inventory falls to 15 or below, an order is placed for 30 units of the product. The lead time for delivery varies and is shown in the column under Lead Time. If the holding costs per unit were $8, what are the total inventory costs for the 20-day period?

A. $2,184

B. $2,240

C. $2,296

D. $2,136

Lorona Inc. has provided the following data concerning the Assembly Department for the month of April. The company uses the weighted-average method in its process costing. MaterialsConversion?Cost per equivalent unit$8.10 $28.50 ?Equivalent units in ending work in process 1,330 1,235 ?? During the month, 7,400 units were completed and transferred from the Assembly Department to the next department. Required:Determine the cost of ending work in process inventory and the cost of units transferred out of the department during April using the weighted-average method.

What will be an ideal response?