Tax law generally disallows deductions for personal expenditures. However, due to legislative grace, there are certain exceptions to this general provision of tax law. These exceptions include

I. Itemized Deductions.

II. Standard Deduction amount.

III. Personal Exemption amounts.

IV. Dependency Exemption amounts

a. Statements I and IV are correct.

b. Statements I, II, and III are correct.

c. Statements I and II are correct.

d. Statements I, II, III, and IV are correct.

e. Statements III and IV are correct.

d

You might also like to view...

Under the indirect method, an increase in accounts payable is added to net income to determine cash flow from operating activities

a. True b. False Indicate whether the statement is true or false

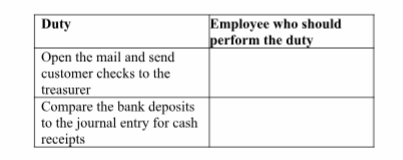

Concerning how companies control cash received by mail, state which employee should perform the following duties:

What will be an ideal response?

What effect will the purchase of treasury stock have on total stockholders' equity and earnings per share, respectively?

a. Increase and decrease b. Decrease and increase c. Decrease and no effect d. Decrease and decrease

A lessee under a consumer lease and a buyer under a sale of goods are provided with the same protections against unconscionability under the UCC

a. True b. False Indicate whether the statement is true or false