The provisions of IFRS require firms to classify marketable securities into which of the following categories?

a. Held to maturity investments for which a firm has both the intent and the ability to hold to maturity—shown on the balance sheet at an amount based on acquisition cost, but subject to impairment.

b. Debt and equity securities held as financial assets at fair value through profit or loss, shown on the balance sheet at fair value, with changes in fair value of securities held at the end of the accounting period reported each period in net income.

c. Debt and equity securities held as available-for-sale financial assets, shown on the balance sheet at fair value, with unrealized changes in fair value of securities held at the end of the accounting period included in other comprehensive income, and realized changes in fair value included in net income when a firm sells the securities.

d. all of the above

e. choices a and b, only.

D

You might also like to view...

Explain the problems associated with Questionable Executive Compensation Schemes

Which of the following terms would make an instrument nonnegotiable?

A) It is dependent upon an event. B)It is undated.? C)It is payable in foreign money.? D)It gives the holder the right to receive interest.

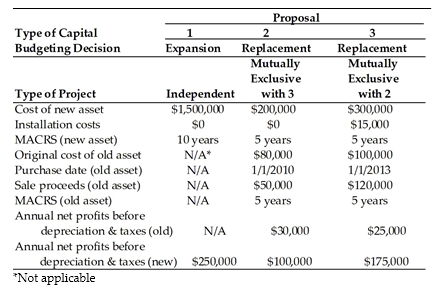

For Proposal 2, the book value of the existing asset at the end of the fifth year is ________. (See Table 11.2)

Table 11.2

Computer Disk Duplicators, Inc. has been considering several capital investment proposals for the year beginning in 2019. For each investment proposal, the relevant cash flows and other relevant financial data are summarized in the table below. New assets will be depreciated under the MACRS system rather than being fully expensed right away. In the case of a replacement decision, the total installed cost of the equipment will be partially offset by the sale of existing equipment. The firm is subject to a 40 percent tax rate on ordinary income and on long-term capital gains. The firm's cost of capital is 15 percent.

A) $13,600

B) $34,400

C) $66,400

D) $80,000

When is the face amount of a Whole Life policy paid?

What will be an ideal response?