Some argue that "financing an investment with your own personal funds is always less expensive than borrowing the funds from a bank because it's an interest-free loan.". To an economist, this argument

a. is true because borrowed funds involve an explicit cost, while use of one's own funds involves only an implicit cost

b. ignores the opportunity cost associated with using one's own funds

c. is false because the bank can always match the interest rate offered on the loanable funds market

d. is true only if the investment generates less revenue than the revenue generated by the interest-bearing deposit in the bank

e. ignores the cost of sacrificing present consumption

B

You might also like to view...

What is the relationship between the marginal product curve and the total product curve?

What will be an ideal response?

The current account shows transactions in goods and services; the capital account shows purchases and sales of assets; and the official reserve transactions account shows movement of international reserves

a. True b. False

The AD curve shifts to the right when

a. the Fed alters its fiscal policy rules b. any economic shock disrupts the economy c. the AS curve does not shift d. new trade legislation is passed e. positive demand shocks occur

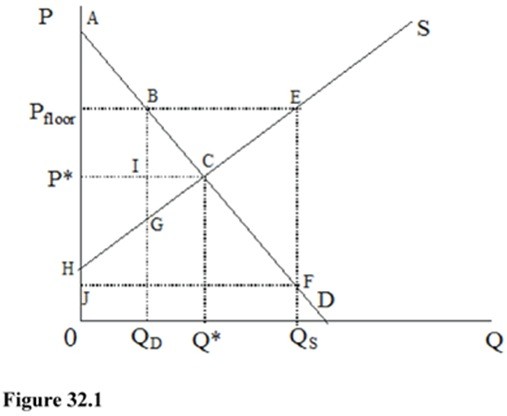

In Figure 32.1, at the market price-quantity combination where production is limited, the consumer surplus is Image

A. APfloorB. B. HP*C. C. HPfloorBG. D. P*AC.