How is the impact of expansionary fiscal policy different in an open economy than in a closed economy?

What will be an ideal response?

In a closed economy, expansionary fiscal policy raises aggregate demand through higher government spending. If the higher spending level is financed by government borrowing, this increase in the deficit raises interest rates and crowds out private consumption and investment. However, the direct effect of higher government spending is strong enough to result in an increase in aggregate demand.

In an open economy, however, the higher interest rate that results from an increase in the deficit also raises exchange rates, which will reduce net exports. Since net exports are also a component of aggregate demand, the impact of expansionary fiscal policy in increasing aggregate demand is more limited in an open economy than in a closed economy.

You might also like to view...

Money illusion occurs when we compare dollar amounts

A. without adjusting for inflation. B. between two years. C. without adjusting for technology. D. between the CPI and the GDP.

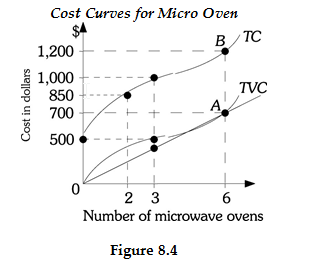

Refer to Figure 8.4. If three microwave ovens are produced, average variable costs are A) $166.67. B) $333.33. C) $500. D) $1,500.

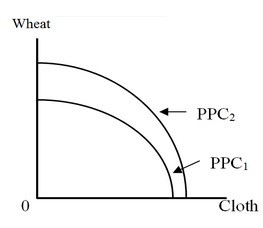

In the figure below, we see an expansion of the production-possibility curve (from PPC1 to PPC2). The two goods produced are wheat and cloth, which are land-intensive and labor-intensive, respectively. The outward shift of the production-possibility curve is likely the result of

A. a fall in the average cost of producing cloth. B. an increase in the national amount of usable land, the size of the labor force remaining unchanged. C. an increase in the size of the labor force, the area under cultivation remaining unchanged. D. an increase in the price of cloth.

Which of the following is NOT a true statement about capital controls?

A) Countries are more able to prevent capital inflows than they were in the 1970s. B) Capital controls may reduce world welfare by preventing capital from moving to its most valuable use. C) It is unclear whether it is best to limit capital inflows, capital outflows, or both. D) Restricting the movement of capital cannot stop a crisis once it has begun.