A business purchasing an item for business purposes may use straight-line depreciation to obtain a tax deduction. The formula for the present value, P, after t years is given below, where C is the cost and s is the scrap value after L years. The number L is called the useful life of the item.

?

?

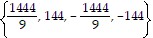

If a certain piece of equipment costs $6,100 and has a scrap value of $2,300 after 5 years, graph the amount you will have in t years. What is the slope of the graph?

?

A.

B.

C.

D.

E.

Answer: D

Mathematics

You might also like to view...

Use the formula indicated to determine the prime number generated for the given value of n.p = n2 - n + 41; n = 3

A. 1847 B. -35 C. 47 D. 53

Mathematics

Solve the equation.3(-13 +  )2 = -4(-13 +

)2 = -4(-13 +  ) - 1

) - 1

A.

B.

C.

D.

Mathematics

Find the trigonometric function value of the corresponding complementary angle.Given that sec 18° ? 1.0515, find csc 72°.

A. 0.3090 B. 3.2361 C. 1.0515 D. 0.9511

Mathematics

Perform the indicated operation and, if possible, simplify. Assume that all variables represent positive real numbers.  ?

?

A.

B. 6x

C. x

D. 5

Mathematics