If the prices of inputs changes, what will happen to the aggregate supply curve?

a. It does not move but the economy moves along the curve.

b. It depends on whether the input prices rise or fall.

c. The curve will become flatter or steeper depending on whether the input prices rise or fall.

d. It shifts inward or outward depending on whether the input prices rise or fall.

d

You might also like to view...

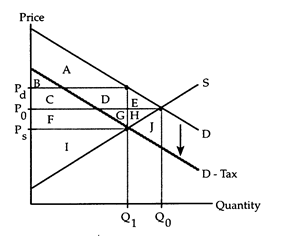

Refer to Sales Tax. After the tax is imposed, social gain is equal to

The following questions refer to the accompanying diagram which shows the effects of a sales tax imposed on consumers. The initial price and quantity are P0 and Q0, respectively. After the tax is imposed, the equilibrium quantity is Q1, firms receive the price Ps, and consumers pay the price Pd.

a. area A + D + E + G + H + J.

b. area B + C + F + I - J.

c. area A + B + C + D + E + F + G + H + I.

d. area A + B + C + D + F + G + I.

Is the poverty rate the lowest among Hispanic households, black households, or white households?

What will be an ideal response?

From 1979 to 2011, which country had the lowest growth rate of GDP per hour of work?

A. Singapore B. United States C. France D. Japan

The reason for the different in tax policy and spending policy by the government is due to:

A. the difference in initial spending that results from engaging in tax policy. B. the fact that when the government engages in spending policy, they do it more aggressively. C. people not responding to tax policy as much as spending policy. D. firms drastically responding to tax changes that are implemented.