Tracy won a $100 million jackpot. She can receive the jackpot as a $5 million payment each year for 20 years, or she can ask to receive the present value of all those payments all at once now. Assume an annual interest rate of 5 percent. If she decides to take the present value payment, about how much will she receive?

A. $52.1 million

B. $62.3 million

C. $71.4 million

D. $78.6 million

B. $62.3 million

You might also like to view...

Negative inflation rates benefit lenders because

A. the real interest rate is negative. B. the nominal interest rate is negative. C. the nominal interest rate is positive. D. the real interest rate is positive.

Two countries are experiencing 10% money growth a year. However, country A is growing at 2% and country B is growing at 5%. Which country will have the higher inflation rate?

What will be an ideal response?

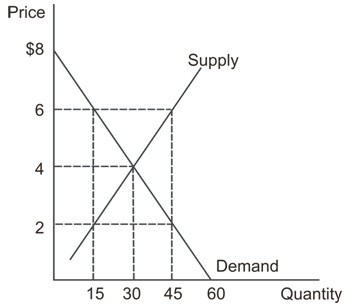

Refer to the graph shown that depicts a third-party payer market for prescription drugs. If the co-payment is $2 per pill, what will be the total market expenditures on prescription drugs?

A. $30 B. $540 C. $90 D. $270

The smaller the marginal propensity to consume

A. the smaller the marginal propensity to save is. B. the large the multiplier is. C. the smaller the multiplier is. D. the smaller autonomous consumption is.