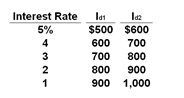

The table gives data on interest rates and investment demand (in billions of dollars) in a hypothetical economy.

Refer to the above table. Assume that the public debt is used to expand the capital stock of the economy and that, as a consequence, the investment-demand schedule changes from Id1 to Id2. At the same time, the interest rate rises from 3% to 4% as the government borrows money to finance the public debt. How much crowding out of private investment will occur in this case?

A. $0

B. $100 billion

C. $600 billion

D. $700 billion

A. $0

You might also like to view...

What is the relationship between individual demand and market demand?

What will be an ideal response?

There is no possibility of further widening of the European Union

Indicate whether the statement is true or false

Which of the following shocks is most likely to cause an expansion?

a. Defense spending falls b. Defense spending rises c. Defense spending rises and then falls d. Oil prices surge upward e. Oil prices rise slowly

Public goods can be provided publicly

Indicate whether the statement is true or false.