The theory of portfolio choice indicates that factors affecting the demand for money include

A) income.

B) nominal interest rate.

C) liquidity of other assets.

D) all the above.

D

You might also like to view...

Suppose expected inflation in the economy is 5%. Banks set nominal interest rates so they'll earn a 2% expected real return. Employers set nominal wages based on a 2% expected real wage increase

Suppose the nominal interest rate and nominal wages are determined this way, but actual inflation turns out to differ from the expected inflation rate. Calculate the actual real interest rate and the percent increase in the real wage for each of the following actual inflation rates: a) 2%; b) 5%; c) 10%.

Mutually beneficial trade is impossible when different persons have different preferences about goods and services.

Answer the following statement true (T) or false (F)

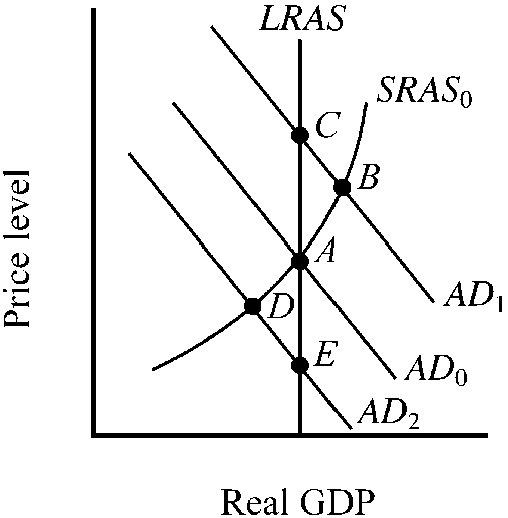

Figure 10-1

At which point in is the economy experiencing an economic boom?

a.

A

b.

B

c.

C

d.

D

Which of the following statements is TRUE about the optimal quantity of pollution?

A) It equals zero. B) Pollution abatement should continue up to the point where marginal cost equals the average total cost. C) Trade-offs exist between producing a cleaner environment and producing other goods and services. D) Firms should be allowed to determine the profit-maximizing amount of pollution abatement.