If we assume the required reserve rate is ten percent (0.1), and that the public does not change their currency holdings and that banks do not hold any excess reserves, what will be the change in deposits resulting from a $150 million open market purchase by the Fed?

What will be an ideal response?

We can use the following equation: ?D =  ?RR where D = the change in deposits, rD = the required reserve rate, and RR is the change in required reserves. When the Fed purchases $150 million of securities in the open market, these become banking system reserves, since one of our assumptions is the banking system does not hold any excess reserves, banks will expand deposits (make loans) until the $150 million injection of reserves are being used as required reserves. Inserting the values of 0.1 for rD and $150 million for RR; the D = $1.5 billion.

?RR where D = the change in deposits, rD = the required reserve rate, and RR is the change in required reserves. When the Fed purchases $150 million of securities in the open market, these become banking system reserves, since one of our assumptions is the banking system does not hold any excess reserves, banks will expand deposits (make loans) until the $150 million injection of reserves are being used as required reserves. Inserting the values of 0.1 for rD and $150 million for RR; the D = $1.5 billion.

You might also like to view...

What is one difference between stocks and bonds?

A) Bonds are purchased at a bank, while stocks are purchased through the federal government. B) Bonds earn a higher rate of return than stocks. C) Stocks earn a higher rate of return than bonds. D) Stocks represent partial ownership in a firm, while bonds do not.

Whenever fiscal policy actions, such as income tax cuts, are utilized to expand the economy, the Keynesians prefer

a. a contractionary monetary policy. b. monetary policy to stay the same because of the liquidity trap. c. accompanying decreases in the money supply that will cause the interest rate to rise and, thus, prevent the crowding out of investment. d. accompanying increases in the money supply in order to prevent the interest rate from rising and, thus, prevent the crowding out of investment. e. both b and/or d

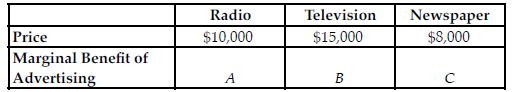

Refer to the table below. If at the current advertising level, A = $10,000, B = $15,000, and C = $8,000, to maximize profit, which of the following should the firm do?

The table above shows the current costs for a firm to advertising on the radio, television, and newspaper.

A) The firm should decrease its advertising on the radio and increase its advertising in newspapers.

B) The firm has optimally allocated their advertising budget, but that does not guarantee that they have maximized their profits.

C) The firm should decrease its advertising on the radio and increase its advertising on television.

D) The firm has optimally allocated their advertising budget, which guarantees they have maximized their profits.

Why do you hold money? According to the classical economists, the only motivation you have for holding money is for

a. transactions purposes b. precautionary purposes c. speculative purposes d. savings purposes e. liquidity purposes