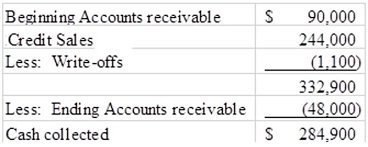

On January 1, Year 2, Burton Company had a balance in Accounts Receivable of $90,000 and a balance in the Allowance for Doubtful Accounts account of $2,400. Burton had credit sales of $244,000 during Year 2 and ended the year with a balance in Accounts Receivable of $48,000. Burton also wrote off $1,100 of receivables during Year 2. Burton uses the allowance method and assumes that 2% of the sales on account will not be collected.Required:a) After adjusting entries on at the end of Year 2, what will be the balance in the Allowance for Doubtful Accounts?b) What was the decrease in the net realizable value of accounts receivable in Year 2 as a result of the write-off of the receivable?c) What amount of cash was collected from customers during Year 2?

What will be an ideal response?

a) $6,180

b) $0

c) $284,900

a) Ending allowance for doubtful accounts = Beginning allowance for doubtful accounts of $2,400 + Uncollectible accounts expense of ($244,000 × 2%) ? Write-off of $1,100 = $6,180

b) Net realizable value = Accounts receivable ? Allowance for doubtful accounts

Write-offs do not affect net realizable value because they decrease both accounts receivable and the allowance for doubtful accounts by the same amount.

c)

You might also like to view...

At the beginning of the recent period, there were 900 units of product in a department, 35% completed. These units were finished and an additional 5,000 units were started and completed during the period. 800 units were still in process at the end of the period, 25% completed. Using the weighted average method, the equivalent units produced by the department were:

A. 6,100 units. B. 5,500 units. C. 6,700 units. D. 5,900 units. E. 5,000 units.

To prove a pattern of racketeering under RICO, at least ________ predicate acts must be

committed by a defendant within a 10-year period. A) 3 B) 1 C) 5 D) 2

A corporation reports the following year-end stockholders' equity: Paid-in capital:? Preferred stock, 8%, 100,000 shares authorized, 50,000 shares issued …………………. $ 2,500,000 Paid-in capital in excess of par, Preferred…………..125,000 Common stock, $1 par, 5,000,000 shares authorized, 4,000,000 shares issued ………………..4,000,000 Paid-in capital in excess of par, Common …………..1,200,000 Total paid-in capital ………………………………..$ 7,825,000Retained earnings ……………………………………..10,675,000Total stockholders' equity …………………………….$18,500,000Determine the following:(1) Par value for the preferred stock.(2) Book value per share for both preferred stock and common

stock assuming no dividends in arrears. What will be an ideal response?

The market rate of return increased by 8% while the rate of return on XYZ stock increased by 4%. The beta of XYZ stock is

A) -2.0. B) -0.40. C) 0.50. D) 2.0.