When banks hold a large amount of excess reserves, which of the following tools would the Fed most likely use when it wants to increase the interest rate?

A. raising the discount rate

B. raising the reserve requirement

C. making an open market purchase

D. raising the interest rate it pays to banks on their reserves

Answer: D

You might also like to view...

A natural monopoly exists when a firm

a. owns all of the world's known reserves of a natural resource. b. has an average cost curve that is decreasing at the point where it crosses demand. c. has obtained a patent on a new genetically modified organism. d. is able to practice price discrimination in the sale of a natural resource.

What will happen when a firm raises the price of a differentiated product in an imperfectly competitive market?

a. It will see lower sales but will not lose all its sales. b. It will lose all its sales to competitor firms. c. It will actually get new customers from other firms. d. It will see an increase in revenues.

People acting in their own self interest is the basis of the:

A. principle of supply and demand. B. principle of voluntary exchange. C. real-nominal principle. D. principle of scarcity.

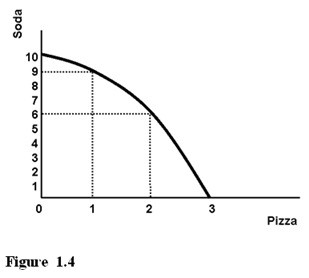

Referring to Figure 1.4, the opportunity cost of producing the first unit of pizza is

A. the same as the opportunity cost of producing the second unit of pizza. B. three units of soda. C. one unit of soda. D. six units of soda.