A reverse tax, or negative income tax, is a way of creating a minimum income for all households while retaining an incentive for people to work

Indicate whether the statement is true or false

T

You might also like to view...

In the long run, changes in the money supply affect only the price level because

a. the aggregate demand curve is vertical. b. the aggregate demand curve is downward sloping. c. the long-run aggregate supply curve is vertical. d. the long-run aggregate supply curve is upward sloping. e. current real GDP is less than the economy's potential GDP.

Suppose you own a firm that produces widgets and is a monopoly. The market demand is given by the equation P = 100 - 2Q, where P is the price of gadgets and Q is the quantity of gadgets sold per week. The firm's marginal costs are given by the equation MC = 16Q. When the monopolist maximizes profits the price elasticity of demand for widgets is

A. 9. B. 36. C. 0.02. D. 0.5.

The marginal productivity theory of income distribution suggests that:

A. government should subsidize the most productive workers through a system of transfer payments. B. each individual should receive income based on his or her contribution to total output. C. resource owners should receive income based on the idea of "from each according to his ability, to each according to his wants." D. resource owners should receive income based upon their needs.

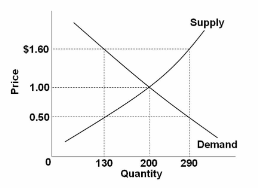

Refer to the diagram showing the domestic demand and supply curves for a specific standardized product in a particular nation. If the world price for this product is $.50, this nation will experience a domestic:

A. shortage of 160 units, which it will meet with 160 units of imports.

B. shortage of 160 units, which will increase the domestic price to $1.60.

C. surplus of 160 units, which it will export.

D. surplus of 160 units, which will reduce the world price to $1.00.