The vast majority of innovations today are radical innovations that obsolete previous technology or ways of doing things.

Answer the following statement true (T) or false (F)

False

You might also like to view...

Companies, as brand authors, generally manage their brands through a variety of product-related activities using traditional marketing and other tools. Describe how MPR helps firms manage three other types of brand authors

What will be an ideal response?

If an employer breaches an employment contract, the employee owes a duty to mitigate damages by trying to find substitute employment

Indicate whether the statement is true or false

The book value of an asset when using double-declining-balance depreciation is always greater than the book value from using straight-line depreciation, except at the beginning and the end of the asset's useful life, when it is the same.

Answer the following statement true (T) or false (F)

Prepare a detailed calculation of consolidated net income. Do not prepare an income statement for this requirement.

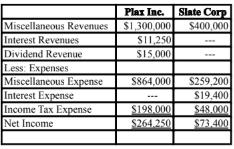

The financial statements of Plax Inc. and Slate Corp for the year ended December 31, 2018 are shown below:

Income Statements

Retained Earnings Statements

Balance Sheets

Other Information:

> Plax acquired 75% of Slate on January 1, 2014 for $196,000, when Slate's retained earnings was $80,000 and the acquisition differential was attributable entirely to goodwill. There were impairment losses to the goodwill of $6,400 and $1,600 in 2015 and 2018 respectively.

> Plax uses the cost method to account for its investment.

> Slate has 10% par value bonds outstanding in the amount of $200,000 which mature on December 31, 2021. The bonds were issued at a premium. On January 1, 2018 the unamortized premium amounted to $2,400 Slate uses the straight line method to amortize the premium.

> On January 1, 2018, Plax acquired $120,000 face value of Slate's bonds for $123,000 Plax also uses the

straight line method to amortize any bond premium or discount.

> Both companies are subject to a 40% tax rate.

> Gains and losses from intercompany bond holdings are to be allocated to the two companies when consolidated financial statements are prepared.

What will be an ideal response?