In the short run, the incidence of a sales tax is

a. wholly absorbed by the producer.

b. shared between the consumer and the producer.

c. deferred until the market is able to re-establish an equilibrium price.

d. wholly absorbed by the consumer.

b

You might also like to view...

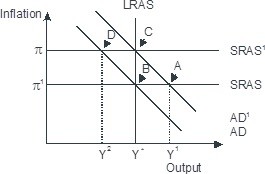

Based on the figure below. Starting from long-run equilibrium at point C, a tax increase that decreases aggregate demand from AD1 to AD will lead to a short-run equilibrium at point ________ and eventually to a long-run equilibrium at point ________, if left to self-correcting tendencies.

A. D; C B. D; B C. A; B D. B; C

A $2.00 increase in the size of a tax on a good will only cause the price for buyers to increase by $2.00 if

A) demand is perfectly inelastic. B) demand is perfectly elastic. C) demand is unit elastic. D) demand is inelastic, but not perfectly inelastic. E) demand is elastic, but not perfectly elastic.

Which of the following changes should make activist policy makers more confident in their capacity to make good policy recommendations?

A) structural change in the economy B) changes in multipliers C) a longer estimated lag for monetary policy D) none of the above

Which of the following will most likely occur under a system of clearly defined and enforced private property rights?

What will be an ideal response?