Because the U.S. economy failed to snap back from a mild recession in 2001, the Fed pushed the federal funds rate down to 1 percent. What effect did this have on the economy?

What will be an ideal response?

When the Fed reduced the federal funds rate to 1 percent, it kept it at that level for over a year. As a result, a number of side effects occurred, which were not part of the planned effect. First, it pushed up the demand for housing, and housing prices, since lower mortgage interest rates made it cheaper to buy. This boost from that monetary policy helped fuel the burgeoning house price bubble, pushing house prices well beyond what could be justified by the fundamentals. Also, because interest rates dropped, investors were encouraged to “reach for yield” and one way to do that was to invest in riskier securities that paid higher interest rates. This led to increased demands for such risky assets as “junk” bonds, emerging-market debt, mortgage-backed securities, and others, pushing up their prices and reducing their yields. These factors helped create the Great Recession.

You might also like to view...

An increase in interest rates might ________ saving because more can be earned in interest income

A) encourage B) discourage C) disallow D) invalidate

A monopsony is a market situation in which there is only one buyer

a. True b. False Indicate whether the statement is true or false

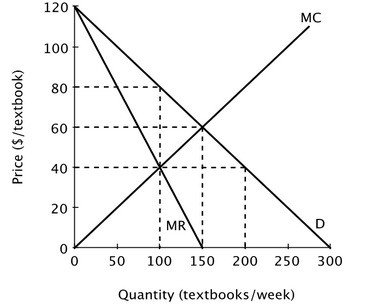

Suppose the accompanying figure shows the demand curve, marginal revenue curve and marginal cost curve for a monopolist. At this monopolist's profit-maximizing level of output, deadweight loss equals ________.

At this monopolist's profit-maximizing level of output, deadweight loss equals ________.

A. $2,000 B. $1,000 C. $6,000 D. $4,000

What is a market surplus, and how does the market attempt to resolve a surplus?

What will be an ideal response?