Which of the following are the most frequently utilized tools of fiscal policy in the United States?

a. Indirect business taxes

b. Corporate income taxes

c. Inheritance taxes

d. Personal income taxes

D

You might also like to view...

If Y>C+I+G but Md= Ms, then

a. interest rates must rise and output must fall. b. both interest rates and output must fall. c. interest rates must fall and output must rise. d. both interest rates and output must rise. e. none of the above.

The deadweight loss from a tax of $x per unit will be smallest in a market

a. in which demand is elastic and supply is inelastic. b. in which demand is inelastic and supply is elastic. c. in which demand is inelastic and supply is inelastic. d. None of the above are correct; we need to know the value of x in order to determine the answer.

What are the two short-run effects of increasing the quantity of nation's money?

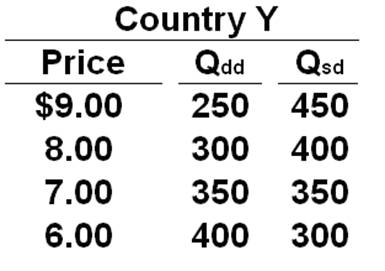

Refer to the table below. At what price will Country Y export 100 units of the product?

Use the following table to answer the question below for Country Y. Column 1 is the price of a product. Column 2 is the quantity demanded domestically (Qdd) and Column 3 is the quantity supplied domestically (Qsd).

A. $9.00

B. $8.00

C. $7.00

D. $6.00