The Occupational Safety and Health Administration (OSHA), the Food and Drug Administration (FDA), and the Internal Revenue Service (IRS) are examples of independent agencies.

Answer the following statement true (T) or false (F)

False

You might also like to view...

Future tax deductions

a. result in deferred tax assets. b. result in deferred tax liabilities. c. occur where the tax basis of liabilities is more than the financial reporting basis. d. occur where the tax basis of assets is less than financial reporting basis.

Multicollinearity is a(n):

A. situation in which several independent variables are highly correlated with each other. B. statistical procedure that estimates regression equation coefficients which produce the lowest sum of squared differences between the actual and predicted values of the dependent variable. C. statistical technique which analyzes the linear relationship between a dependent variable and multiple independent variables by estimating coefficients for the equation for a straight line. D. statistic that compares the amount of variation in the dependent measure "explained" or associated with the independent variables to the "unexplained" or error variance. E. estimated regression coefficient that has been recalculated to have a mean of zero and a standard deviation of 1.

Choose the correct verb in parentheses. I (should, would) ask Laurie to help me, if she wasn't so busy

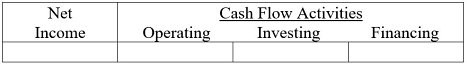

Use the information below to answer the following question(s):Howard Co. uses the direct method to prepare its operating activities section of the statement of cash flows. Indicate how each event affects net income and the three types of activities on the statement of cash flows. In the net income column, use the letter "I" to indicate increase, the letter "D" to indicate decrease, and the letters "NA" to indicate no effect on net income. In the three cash flow columns, use the letter "I" to indicate cash inflow, the letter "D" to indicate cash outflow, and the letters "NA" to indicate no effect on cash flows.At the beginning of the current year, Howard Co. paid cash to purchase equipment costing $80,000. There was $10,000 of depreciation expense recognized during the accounting period.

(Show the combined effects of these two events.)

What will be an ideal response?