Martha died and by her will, specifically bequeathed, and the executor distributed, $20,000 cash and a $70,000 house to Harold. The distributions were made in a year in which the estate had $65,000 of DNI, all from taxable sources. The maximum Harold will be required to report as gross income as a result of these distributions is

A. $65,000.

B. $20,000.

C. $0.

D. $70,000.

Answer: C

You might also like to view...

Bantam Industries has budgeted the following information for March: Cash receipts$271,000 Beginning cash balance 5,000 Cash payments 280,000 Desired ending cash balance 25,000 If there is a cash shortage, the company borrows money from the bank. All cash is borrowed at the beginning of the month in $1,000 increments and interest is paid monthly at 1% on the first day of the following month. The company had no debt before March 1st. How much cash will the company need to borrowed in March?

A. $4,000 B. $29,000 C. The company should not need to borrow any cash in March D. $25,000

Stop orders are used only when selling a stock

Indicate whether the statement is true or false.

The weighted-average method of process costing differs from the FIFO method of process costing in that the weighted-average method:

A. will always yield a higher cost per equivalent unit. B. does not consider the degree of completion of beginning work in process inventory when computing equivalent units of production. C. considers ending work in process inventory to be fully complete. D. All of the choices are correct.

Calculate the dual price for each resource.

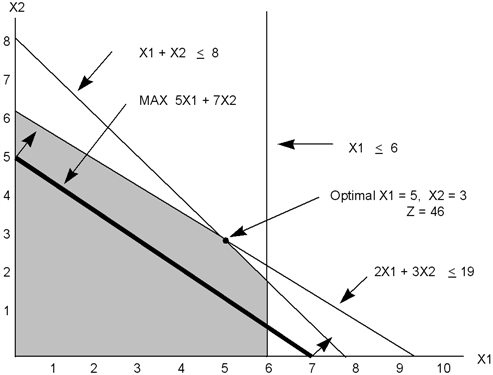

Consider the following linear program:

Max 5x1 + 7x2

s.t. x1 ? 6

2x1 + 3x2 ? 19

x1 + x2 ? 8

x1, x2 ? 0

The graphical solution to the problem is shown below. From the graph, we see that the optimal solution occurs at x1 = 5, x2 = 3, and z = 46.