A contractor who files as unmarried (single) to the IRS has an effective tax rate of 28%. His gross income is $155,000, other income is $4000, personal expenses are $45,000, and deductions and exemptions are $12,000. His total income tax due is closest to: (choose one)

(a) $28,550

(b) $41,160

(c) $43,400

(d ) $55,750

Taxes = (155,000 + 4,000 - 12,000)(0.28)

= 147,000 (0.28)

= $41,160

Answer is (b) $41,160

Trades & Technology

You might also like to view...

In the bird's eye view, the ____________________ surfaces are hidden from view.

Fill in the blank(s) with the appropriate word(s).

Trades & Technology

What is the purpose of a zoning ordinance and which organization produces it?

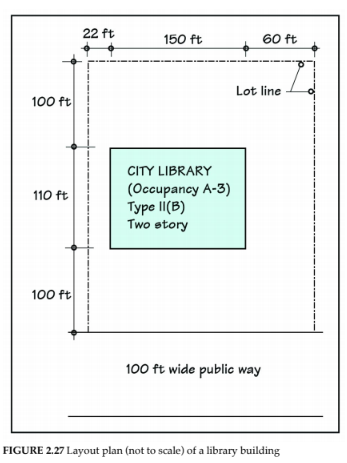

Use the figure below to answer the following questions.

Trades & Technology

Proper lighting requires approximately _____ square foot of window space for each 20 square feet of

floor area.

a. 1 c. 2 b. 3 d. 4

Trades & Technology

When soldering, the technician should heat the solder with the torch to allow it to melt.

Answer the following statement true (T) or false (F)

Trades & Technology