Which of the following information cultures would have the greatest negative impact on Apple's business?

A. Information-functional culture.

B. Information-sharing culture.

C. Information-inquiring culture.

D. Information-discovery culture.

A. Information-functional culture.

You might also like to view...

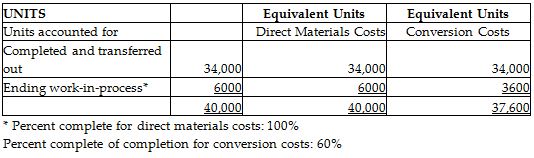

Herbicida Manufacturing produces a chemical herbicide and uses process costing. There are three processing departments—Mixing, Refining, and Packaging. On January 1, the first department—Mixing—had no beginning inventory. During January, 40,000 fl. oz. of chemicals were started in production. Of these, 34,000 fl. oz. were completed, and 6000 fl. oz. remained in process. In the Mixing Department, all direct materials are added at the beginning of the production process, and conversion costs are applied evenly throughout the process. The weighted-average method is used.

At the end of the month, Herbicida calculated equivalent units in the Mixing Department as shown below:

During January, the Mixing Department incurred $49,000 in direct materials costs and $213,000 in conversion costs. How much was the cost per equivalent unit for materials and for conversion costs?

(Use the weighted-average method and round your answer to the nearest cent.)

A) $8.17 per EUP for direct materials and $5.33 per EUP for conversion costs

B) $1.23 per EUP for direct materials and $6.26 per EUP for conversion costs

C) $1.44 per EUP for direct materials and $6.26 per EUP for conversion costs

D) $1.23 per EUP for direct materials and $5.66 per EUP for conversion costs

Reading an oral presentation directly from notes or slides ________

A) is an effective technique for beginning speakers B) is a good idea to ensure that everything is covered C) allows the speaker to use on-the-spot nonverbal feedback from the audience D) causes the audience to lose confidence in the speaker's expertise

For a state to tax a business, the state must have:

a. rules for dividing the company's income into an in-state and an out-of-state portion b. rules for determining how much of a company's income is profit c. rules for determining which employees made the majority of the income d. rules for determining the costs of operations in other states e. none of the other choices are correct

Five years ago, George and Jerry (his brother) provide $40,000 and $60,000, respectively, to purchase realty titled in the names of George and Jerry as joint tenants with right of survivorship. George dies in the current year and is survived by Jerry. At the time of George's death, the realty is valued at $300,000. What is the value of the realty in George's gross estate?

What will be an ideal response?