A commercial bank holds $500,000 in demand deposit liabilities and $120,000 in reserves. If the required reserve ratio is 20 percent, which of the following is the maximum amount by which this single commercial bank and the maximum amount by which the banking system can increase loans?

a) amount created by single bank = $5,000 and amount created by banking system = $25,000

b) acsb=$20,000 and acbs=$80,000

c) acsb=$20,000 and acbs=$100,000

d) acsb=$0,000 and acbs=$150,000

e) acsb=$120,000 and acbs=$500,000

Ans: c) acsb=$20,000 and acbs=$100,000

You might also like to view...

Refer to the information above. If an economy has a real GDP doubling-time of 48 years, this can be reduced to 30 years if annual GDP growth is raised by ________ percentage points

A) 4 B) 2.4 C) 1.6 D) 0.9

A limit on the amount of strawberries that can be imported into the United States is an example of

A) the rationing function of prices protecting domestic strawberry farmers. B) a price floor set by the government. C) a price ceiling set by government. D) an import quota.

If the MPC is .9 and government spending increases by $10 billion, GDP will rise by $_____ billion.

A. 9 B. 10 C. 90 D. 100

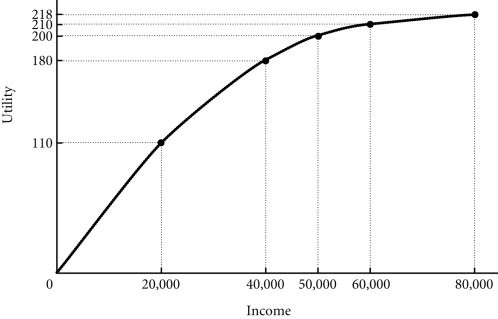

Refer to the information provided in Figure 17.1 below to answer the question(s) that follow.  Figure 17.1 Refer to Figure 17.1. Suppose John's utility from income is given in the figure. From this we would say that John is

Figure 17.1 Refer to Figure 17.1. Suppose John's utility from income is given in the figure. From this we would say that John is

A. risk-loving. B. risk-averse. C. a risk taker. D. risk-neutral.