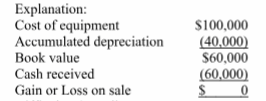

A company sold equipment that originally cost $100,000 for $60,000 cash. The accumulated depreciation on the equipment was $40,000. The company should recognize a:

A) $0 gain or loss.

B) $20,000 gain.

C) $20,000 loss.

D) $40,000 loss.

E) $60,000 gain.

A) $0 gain or loss.

You might also like to view...

When you're selecting keywords to include your résumé, you should

A) never use more than three of them at a time. B) work them into your introductory statement and other résumé sections. C) avoid placing them in a keyword summary at the end of the résumé. D) choose strong verbs and colorful adjectives. E) limit keywords to a bulleted list on the first page of your résumé.

In the two-period model, suppose a household's income in the first period is $40,000, income in the second period is $50,000, and the real interest rate is 25 percent. The government proposes to give the household a tax rebate of $5,000 in the first period, but will tax the household an additional $5,000 × 1.25 = $6,250 in the second period. The household is ____ under the government's tax rebate plan compared with before.

A. better off B. worse off C. equally well off D. possibly better off and possibly worse off

As you improve your working draft, craft powerful sentences by using active voice. In a sentence with active voice, the subject of the sentence is the _________ of the action. A. arbiter B. receiver C. doer

Fill in the blank(s) with correct word

Orangewood Industries bought a new cash register for $7,500. Orangewood originally planned to use the cash register for 4 years and then sell it for $600. After 4 years, Orangewood had recorded $6,900 of depreciation. If the company continues to use the cash register, still planning to sell it eventually for $600, then Orangewood should record:

A. $1,725 of additional depreciation. B. the removal of the cash register from its books because it is fully depreciated. C. no additional depreciation. D. $600 of additional depreciation.