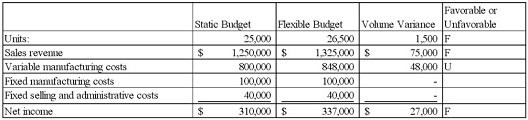

Opal Manufacturing Company established the following standard price and cost information: Sales price$50per unitVariable manufacturing cost 32per unitFixed manufacturing cost$100,000totalFixed selling and administrative cost$40,000total Opal expected to produce and sell 25,000 units. Actual production and sales amounted to 26,500 units.Required:(a) Determine the sales volume variances, including variances for number of units, sales revenue, variable manufacturing cost, fixed manufacturing cost, and fixed selling and administrative cost. (b) Classify the variances as favorable (F) or unfavorable (U). (c) Comment on the usefulness of the variances with respect to performance evaluation. (d) Explain why the fixed cost variances are zero.

What will be an ideal response?

(a), (b)

(c) The variances are of little value for performance evaluation because they do not take into account actual costs or selling price. The variances result simply from the fact that actual volume was greater than expected, and that is the only aspect of performance that can be evaluated from these variances.

(d) The fixed cost variances are zero because both static budget and flexible budget simply include the budgeted total fixed costs. These variances do not show amounts of overhead applied to products or actual amounts of overhead costs incurred.

You might also like to view...

Current GAAP recommends that the fair value method be used to account for compensatory stock option plans. From a conceptual point of view, this method is an improvement over the intrinsic value method.Required:Explain how the fair value method is an improvement over the intrinsic value method.

What will be an ideal response?

________ is a regression procedure in which the predictor variables enter or leave the regression equation one at a time

A) Multiple regression B) Bivariate regression C) Dummy variable regression D) Stepwise regression

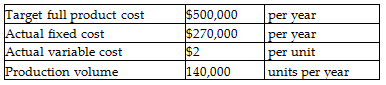

Actual costs are currently higher than target full product cost. Assume all products produced are sold. Assuming that variable costs are dependent on commodity prices and cannot be reduced, what is the target fixed cost?

Discourse Stationery Company is a price-taker and uses target pricing. The company has completed an analysis of its revenues, costs, and desired profits and has calculated its target full product cost. Refer to the following information:

A) $230,000

B) $280,000

C) $220,000

D) $500,000

In the United States, sales contracts and contracts for the payment of money are not assignable

Indicate whether the statement is true or false