Assume that business investment spending rises, and the increase is funded by greater borrowing in the capital markets. If the nation has low mobility international capital markets and a fixed exchange rate system, what happens to the GDP Price Index and the nominal value of the domestic currency in the context of the Three-Sector-Model?

a. The GDP Price Index rises and nominal value of the

domestic currency falls.

b. The GDP Price Index falls and nominal value of the domestic currency rises.

c. The GDP Price Index rises and nominal value of the domestic currency remains the same.

d. The GDP Price Index rises and nominal value of the domestic currency rises.

e. There is not enough information to determine what happens to these two macroeconomic variables.

.C

You might also like to view...

Investment in safety at the firm level poses a prisoners' dilemma because

A) if each firm plays its dominant strategy, joint profits are maximized. B) if each firm plays its dominant strategy, joint profits are not maximized. C) neither firm has a dominant strategy. D) the Nash equilibrium is not achieved.

If the demand for apples is highly elastic and the supply is highly inelastic, then if a tax is imposed on apples it will be paid: a. largely by the sellers of apples

b. largely by the buyers of apples. c. equally by the sellers and buyers of apples. d. by the government.

If the price of housing increases dramatically, then the CPI......

What will be an ideal response?

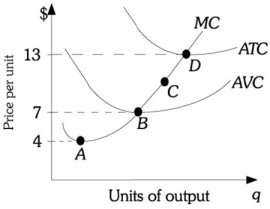

Refer to the information provided in Figure 9.3 below to answer the question(s) that follow.  Figure 9.3Refer to Figure 9.3. This firm will continue to operate in the short run, but incur an economic loss if price is

Figure 9.3Refer to Figure 9.3. This firm will continue to operate in the short run, but incur an economic loss if price is

A. between $0 and $4. B. between $4 and $7. C. between $7 and $13. D. above $13.