Explain the criteria used to assess the results of a corporate ethics program.

What will be an ideal response?

Answers may vary.

You might also like to view...

[APPENDIX] Wave Corporation is determining its income tax liability. It has one machine that cost $30,000 with a 4-year life and no salvage value. Wave is using an accelerated depreciation method for tax purposes. For accounting purposes, Wave has decided to use the straight-line method. Which of the following statements is true?

a. There will be a temporary difference between accounting income and income for tax purposes. b. There will be a permanent difference between accounting income and income for tax purposes. c. Wave's accounting income and income for tax purposes will be equal. d. Accounting income will be lower than income for tax purposes, especially in the early years of the asset's life.

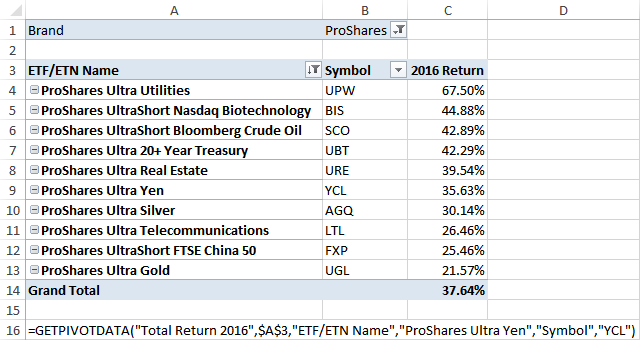

What would be the value of cell D4?

a) 44.88%

b) 30.14%

c) 35.63%

d) 21.57%

e) YCL

Meister Bros. shipped 250 radiator belts to fill Braybon's order. Quality control measures had been in place in Meister's factory when the belts were manufactured. When Braybon received the order one day before it was due, it notified Meister that it rejected the belts because of a variation from the contract specifications. Meister, although it believed the original belts met the contract

specifications, notified Braybon that it would supply conforming goods within one week. When the conforming goods arrive in one week a. Braybon must accept them, but does not have to pay the full price because the contract deadline has passed. b. Braybon does not have to accept them because Meister Bros. only has one chance to fill the order correctly. c. Braybon should accept them because Meister Bros. has a right to cure even after the contract deadline under these circumstances. d. Braybon does not have to accept them because Meister Bros. failed to meet its UCC requirement to deal in good faith.

In a linear programming model, the decision maker always seeks to minimize the objective function

a. True b. False