Jenna Manufacturers produces flooring material

The monthly fixed costs are $16,000 per month. The sales price per unit is $95 and variable cost per unit is $35. If Jenna's managers create a CVP graph from volume levels of zero to 800 units, at what sales level (in units) will the revenue and total cost lines intersect? (Round your answer up to the nearest whole unit.)

A) 267 units

B) 169 units

C) 458 units

D) 124 units

A .A) Required sales in units = (Fixed costs + Target profit) / Contribution margin per unit

Unit contribution margin = Net sales revenue per unit - Variable costs per unit

Sales price $95

Less: variable cost (35 )

Contribution margin 60

Fixed costs 16,000

Required sales in units ($16,000 / $60 ) $267

You might also like to view...

Which of the following is/are not true?

a. Common and preferred stock usually have a par or stated value. b. Firms report amounts received from issuing common stock in excess of the par or stated value as Additional Paid-In Capital or a similar account title. c. Firms report amounts received from issuing common stock in excess of the par or stated value as Additional Paid-In Capital, or Capital in Excess of Par Value or a similar account title. d. The amounts in Additional Paid-In Capital for a firm usually exceeds the amounts in Common Stock, indicating that the firm issued common stock for substantially more than par value, a common practice among publicly traded firms. e. none of the above

After a witness is sworn in, he or she is cross-examined by the plaintiff's attorney

Indicate whether the statement is true or false

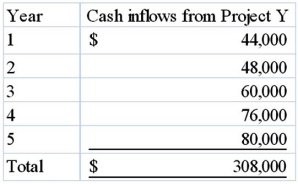

Montana Company is evaluating two different capital investments, Project X and Y. Either X or Y would cost $210,000, and the company cannot afford to do both. The company expects that Project X would provide net cash inflows of $62,000 per year for 5 years. For Project Y, the net cash inflows are expected to be as follows:  Montana's cost of capital is 12%. (PV of $1 and PVA of $1) (Use appropriate factor(s) from the tables provided.)Required:1) Calculate the present value index for Project X and for Project Y. Round your answer to three decimal places. 2) Indicate whether each of the projects is an acceptable investment. 3) Based on present value

Montana's cost of capital is 12%. (PV of $1 and PVA of $1) (Use appropriate factor(s) from the tables provided.)Required:1) Calculate the present value index for Project X and for Project Y. Round your answer to three decimal places. 2) Indicate whether each of the projects is an acceptable investment. 3) Based on present value

index, which of the two projects should Montana implement? What will be an ideal response?

Informational reports should be written using the direct organizational strategy

Indicate whether the statement is true or false