In the United States, the good or service given the most weight in the CPI basket when calculating the CPI is

A) food and beverages.

B) taxes.

C) medical care.

D) housing.

E) recreation.

D

You might also like to view...

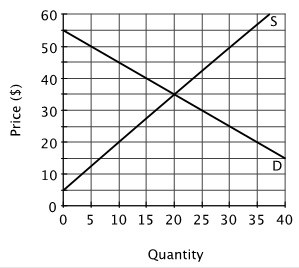

Refer to the figure below. If the government imposed a price ceiling of $40, what would happen in this market?

A. There would be excess supply. B. The equilibrium quantity would fall. C. The price ceiling would have no effect. D. There would be excess demand.

An optimizing consumer has to choose between two goods–Good A priced at PA and Good B priced at PB

Given that MBA is the marginal benefit from consuming Good A and MBB is the marginal benefit from consuming Good B, the consumer's well-being will be maximized at the point where: A) MBA = MBB. B) MBA/PB=MBB/PA. C) MBA/PA = MBB/PB. D) MBA = MBB/PB.

Which of the following is NOT a private cost?

A) the health insurance costs a firm must pay for its employees B) the pollution caused by a firm dumping its wastes into the river C) the coffee pot that Jan dropped and broke this morning D) the amount that a firm must pay for raw materials to make its product

A lump-sum tax is:

A. a head tax. B. the most efficient form of taxation. C. a tax that charges the same amount to each taxpayer. D. All of these statements are true.