Fiscal policy is defined as changes in federal ________ and ________ to achieve macroeconomic objectives such as price stability, high rates of economic growth, and high employment

A) taxes; the money supply B) taxes; interest rates

C) taxes; expenditures D) interest rates; money supply

C

You might also like to view...

A perfectly competitive firm will continue to operate in the short run when the market price is below its average total cost if the

A) marginal revenue is greater than marginal cost. B) price is at least equal to the minimum average variable cost. C) total fixed costs are less than total revenue. D) marginal cost is minimized. E) price is also less than the minimum average variable cost.

If Sam Sneed desires a loan from the Marshall National Bank but the bank only has its legally required reserves on hand, then

a. Sam must go to another bank for his loan b. the Marshall National Bank can borrow directly from a state-chartered bank c. the Marshall National Bank cannot grant the loan because it is state chartered d. the Marshall National Bank can reduce its reserves e. the Marshall National Bank can borrow from its district Federal Reserve Bank

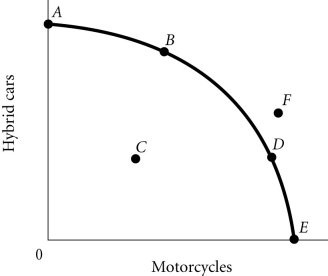

Refer to the information provided in Figure 2.4 below to answer the question(s) that follow. Figure 2.4According to Figure 2.4, Point E necessarily represents

Figure 2.4According to Figure 2.4, Point E necessarily represents

A. only motorcycles being produced. B. overallocation of resources. C. an impossible production point. D. technological advancement.

Matt fishes for tuna at a cost of $4 per ton. John fishes at a cost of $6 per ton. Each has a 1000 ITQ. The current market price is $8 per ton. What amount could Matt pay John to induce him to sell his ITQ?

A. $1000 B. $2000 C. $3000 D. It would not be profitable for Matt to buy John's ITQ