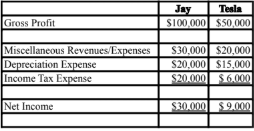

The amount of Miscellaneous Revenues/Expense appearing on Jay's 2019 Consolidated Income Statement would be:

Jay Inc. owns 80% of Tesla Inc. and uses the cost method to account for its investment. The 2019 income statements of both companies are shown below.

On January 1, 2019, Tesla sold equipment to Jay at a profit of $3,000. The equipment had a remaining useful life of twenty years on that date. Both companies are subject to an effective tax rate of 40%.

A) $50,000. B) $47,600. C) $47,000. D) $53,000.

D) $53,000.

You might also like to view...

The following are reasons to use guerilla marketing, except:

A) to create buzz B) to reach consumers that cannot be reached with traditional advertising C) to interact with consumers D) to build relationships with consumers

Consider Figure 6.3. Of the quota-induced change in Iraqi consumer surplus, $______________ is NOT transferred to other sectors of Iraq's economy and represents deadweight loss.

a. $5,000 b. $10,000 c. $15,000 d. $20,000

A follower who takes things at face value will ______.

a. tend to be creative and innovative b. tend to be inquisitive c. tend to accept the established way of doing things d. not be loyal

A company that sells paper stationery made of recycled materials, which no other paper manufacturing company in the market has the ability produce, has a competitive advantage

Indicate whether the statement is true or false a. True b. False