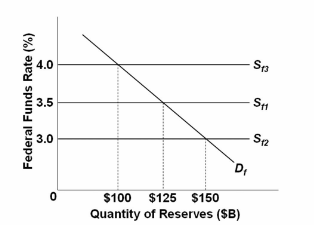

Refer to the diagram for the federal funds market. The equilibrium federal funds rate:

A. depends on the supply of federal funds (reserves).

B. is 3.0 percent.

C. is 3.5 percent.

D. is 4.0 percent.

A. depends on the supply of federal funds (reserves).

You might also like to view...

Someone who is risk-averse has

A) diminishing marginal utility of wealth. B) constant marginal utility of wealth. C) increasing marginal utility of wealth. D) less marginal utility of wealth than someone who is risk-neutral.

Income inequality exists in the United States. Is this necessarily a bad thing? Explain how our assessment of income inequality depends crucially on the source of that inequality

If we look at the value of money in terms of how many units of a good it takes to buy one dollar, then inflation means:

A. it would take fewer goods to buy the same dollar. B. it would take more goods to buy the same dollar. C. the same number of goods would buy fewer dollars. D. it would take fewer dollars to buy the same goods.

Refer to the data provided in Table 17.4 below to answer the following question(s). The table shows the relationship between income and utility for Celeste.Table 17.4 IncomeTotal Utility $0 0 $40,00050 $80,00090$120,000120$160,000140Refer to Table 17.4. Suppose Celeste has a 1/3 chance of becoming disabled in any given year. If she does become disabled, she will earn $0. If Celeste does not become disabled, she will earn her usual salary of $120,000. Celeste has the opportunity to purchase disability insurance which will pay her her full salary in the event she becomes disabled. Such an insurance policy would be worth ________ to Celeste.

A. $0 B. $40,000 or less C. more than $40,000 but less than $80,000 D. $80,000 or more