Double taxation of corporate earnings

a. tends to restrict the activities of corporate firms.

b. causes stockholders to earn a lower return than they would on other securities of comparable risk.

c. results in more investment in research and development.

d. All of the above are correct.

a

You might also like to view...

In the long run, the Phillips curve is a ________ at ________.

Fill in the blank(s) with correct word

Which of the following statements is true?

A) An excess demand for credit exerts an upward pressure on the real rate of interest. B) At rates of interest below the equilibrium rate, there is an excess supply of credit. C) An excess supply of credit exerts an upward pressure on the real rate of interest. D) At rates of interest above the equilibrium rate, there is an excess demand for credit.

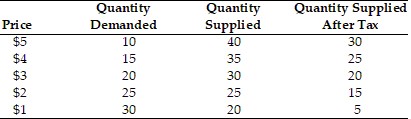

The demand and supply of a product is given in the above table. A unit tax of $2 is imposed on the product. The equilibrium quantity for this product after the tax is imposed is equal to

The demand and supply of a product is given in the above table. A unit tax of $2 is imposed on the product. The equilibrium quantity for this product after the tax is imposed is equal to

A. 25 units. B. 30 units. C. 15 units. D. 20 units.

Related to the Economics in Practice on p. 105: Researchers found that a ten percent reduction in the tax rate induced a twenty percent increase in migration in Europe. This indicates that labor migration in Europe is

A. inelastic. B. elastic. C. unit elastic. D. perfectly inelastic