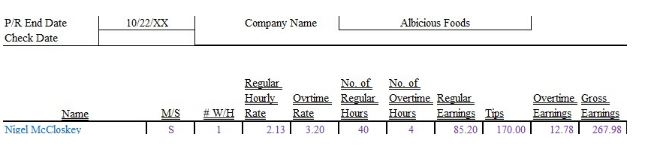

Nigel McCloskey is a waiter at Albicious Foods in South Carolina. He is single with one withholding allowance. He receives the standard tipped hourly wage. During the week ending October 22, 20XX, he worked 44 hours and he received $170 in tips. Calculate his gross pay, assuming his times are included in the overtime rate determination.

What will be an ideal response?

Nigel’s wages for the week (hourly rate * hours) = $85.20 ($2.13 * 40); In South Carolina, the minimum wage for tips is $2.13/hour.

Nigel’s overtime wages for the week (hourly rate * 1.5 * hours) = $12.78 (2.13 * 1.5 * 4)

Nigel’s gross pay (wages + tips) = $267.98 ($97.98 of wages + $170 of tips)

Minimum wage for South Carolina (none – follow FLSA) = $290 ($7.25 * 40 hours)

How much does Albicius Foods need to contribute to Nigel’s wages to meet FLSA requirements? $22.02 ($290.00 – $267.98)

You might also like to view...

The buyer and seller must act in good faith in the performance of a sales contract.

Answer the following statement true (T) or false (F)

Radical innovation often involves open-ended experimentation which can be very time consuming.

Answer the following statement true (T) or false (F)

"Valuing diversity" essentially means accepting accents or language, dress or food of employees whose race, ethnicity, or gender differs from your own.

Answer the following statement true (T) or false (F)

An output of integrated MRP-JIT systems, which is unavailable in an only-MRP system, is a ______.

A. performance report B. time-phased material requirement C. total production cost D. production schedule