Financing expansionary fiscal policy by increasing the deficit does not generally affect interest rates.

Answer the following statement true (T) or false (F)

False

Financing a deficit normally raises interest rates because the government must issue additional bonds to finance the deficit. Higher interest rates have offsetting effects because they reduce business investment.

You might also like to view...

If a $10 billion increase in investment leads to a $20 billion increase in GDP, the multiplier is

A) 0.5 B) 2 C) 10 D) 30

A fall in the price level will: a. cause an upward movement upward along the aggregate demand curve. b. cause a downward movement along the aggregate demand curve

c. cause a leftward shift of the aggregate demand curve. d. cause a rightward shift of the aggregate demand curve. e. have no impact on the aggregate demand curve.

Which of the following is an asset for both a bank and a central bank?

A) currency B) deposits C) bonds D) all of the above E) none of the above

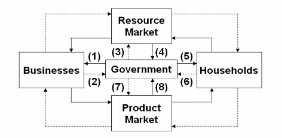

Refer to the diagram, in which solid arrows reflect real flows; broken arrows are monetary flows. Flow (8) might represent:

A. personal income taxes.

B. automobile purchases by the state of Maine.

C. the services of firefighters.

D. subsidies to farmers.