Suppose a company is considering the construction of a new facility. The construction will cost $1 million today and will yield a payoff of $1.7 million in 10 years. Assuming a 5% annual interest rate, which of the following statements is correct?

a. The company should not construct the new facility because the future value of the construction cost is only $1,628,894.63.

b. The company should not construct the new facility because the future value of the construction cost is $1,783,267.42.

c. The company should construct the new facility because the present value of the future payoff is $1,092,734.95.

d. The company should construct the new facility because the present value of the future payoff is $1,043,652.53.

d

You might also like to view...

The corporate income tax is the single largest source of revenue for the federal government.

Answer the following statement true (T) or false (F)

The income that people earn in resource or factor markets is called:

a. national income. b. personal income. c. disposable personal income. d. transfer payments. e. net national product.

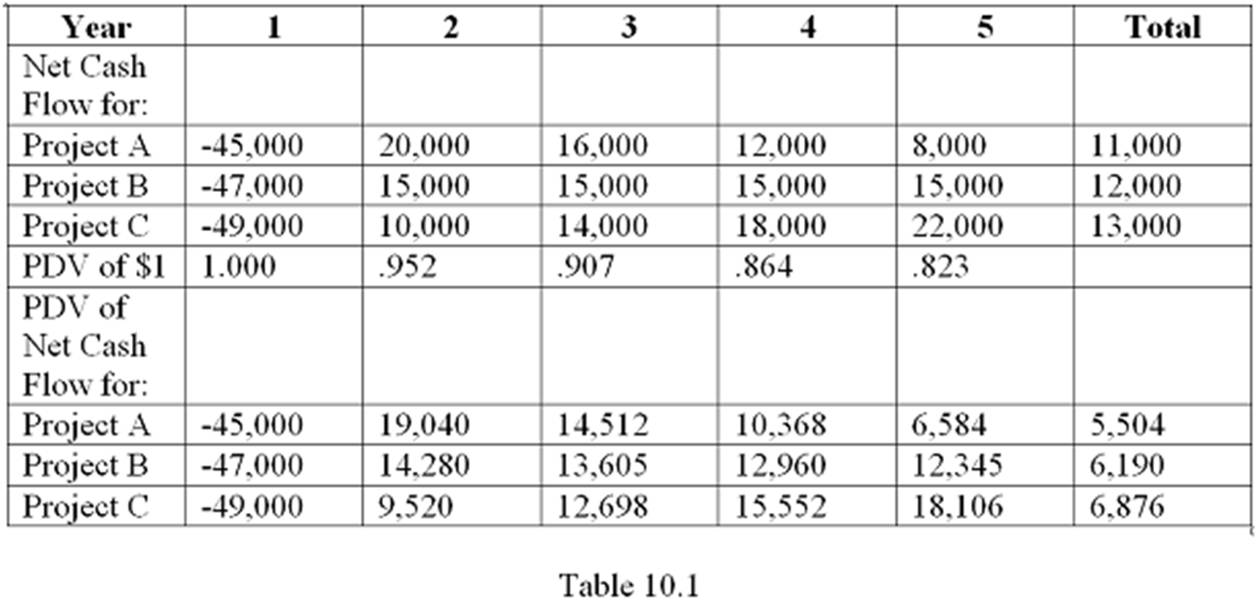

Table 10.1 shows the cash flows and discounted cash flows for three mutually exclusive projects available to a company. Assume an interest rate of 5%. Which project has the highest NPV?

A. Project A

B. Project B

C. Project C

D. It cannot be determined from the information given.

In the U.S., the two components of the receiving water quality standards are

a. the BAT and the BCT b. use-support status and effluent limitations c. the use designation and water quality criteria d. the zero discharge goal and the NPDES